You’re working hard to build equitable, transparent pay systems—but staying compliant with ever-changing employment laws can feel like a moving target. From pay transparency mandates to complex FLSA exemption tests, even well-intentioned organizations find themselves vulnerable to legal risk.

And in mission-driven spaces—where values and people matter most—getting it wrong doesn’t just impact your legal standing. It can erode trust across your team.

This guide breaks down the key legal compliance areas that trip up nonprofits, schools, and philanthropic organizations—and what you can do to protect your people and your mission.

Table of Contents

1. Compensation Compliance Pitfalls: What Most Organizations Get Wrong

2. Pay Transparency Is Here—Are You Ready for It?

3. Good Intentions ≠ Legal Compliance

4. Where Discrimination Claims Begin

5. Maternity, Bonding Leave, and Other Legal Gray Areas

6. What You Can Consider in Pay Decisions

7. How to Start Auditing Your Compensation Program

8. Know When to Bring in Outside Help

9. Compliance Is a Cornerstone of Equity

10. Read the eBook: Compensation with Purpose

11. Additional Resources to Support Compliance and Equity

This post is intended to offer general guidance—not legal advice. Every organization’s context is different. For complex issues related to FLSA, pay transparency, or discrimination risk, we strongly recommend consulting with qualified legal counsel or HR compliance professionals.

1. Compensation Compliance Pitfalls: What Most Organizations Get Wrong

If you're unsure whether your salaried employees are truly "exempt" from overtime pay, you’re not alone. Many organizations assume that a salaried title, such as “Manager” or “Coordinator,” is sufficient to qualify under the Fair Labor Standards Act (FLSA). But the law says otherwise.

Here’s the truth:

Every employee is legally entitled to overtime pay unless they meet all the criteria under both federal and state exemption tests.

For example:

-

To qualify for the Executive Exemption, an employee must supervise two or more FTEs and be regularly involved in hiring, firing, and performance decisions.

-

The Administrative Exemption requires employees to work in a corporate-wide function (like HR or Finance) and regularly exercise independent judgment on decisions that affect the organization.

Most nonprofit staff fall in the middle income bracket—earning between $35K and $107K—where job duties and documentation become the deciding factor. And if your job descriptions aren’t accurately reflecting exempt-level responsibilities, they can be used against you.

Action Step:

Audit your job descriptions against the Department of Labor’s FLSA exemption checklist. A simple three-page PDF could save you from a costly lawsuit.

2. Pay Transparency Is Here—Are You Ready for It?

In more states each year, organizations are legally required to publish salary ranges in job postings. But here’s where it gets tricky: many organizations don’t yet have a compensation structure to back those numbers up.

So what happens? They post a number that seems reasonable, staff sees the posting, and the questions start rolling in:

-

Why is this new role earning more than mine?

-

Is there a pay structure here?

-

Am I being undervalued?

Sharing compensation data without context creates more questions than clarity.

That’s why we often say: if you’re going to share one puzzle piece, you’d better be ready to show the whole picture. A transparent compensation program—complete with ranges, rationale, and consistent application—builds trust. A single job posting with no framework behind it? That’s a trust risk.

Action Step:

If your state requires pay transparency, make sure you also have:

-

Documented salary ranges

-

Strategic communication strategies for your internal team

Download to Learn How to Launch Pay Transparency With Confidence

Get the Pay Transparency Roadmap to meet legal requirements, avoid risks, and roll out salary transparency that benefits your team and keeps you competitive.

3. Good Intentions ≠ Legal Compliance

Many equity-minded organizations unintentionally cross legal lines in an effort to do right by marginalized groups. For example:

-

Prioritizing a candidate based on race or gender in final hiring decisions.

-

Offering severance only to employees from historically marginalized groups.

-

Providing unequal parental leave based on gender identity.

These actions may align with your values—but they’re not legally defensible.

The Supreme Court has made it clear: affirmative action is no longer lawful in employment contexts. All identity groups now share equal legal protection—and the burden of proof in discrimination cases is the same for everyone. That includes claims of reverse discrimination, which are expected to rise.

Favoring any demographic group—no matter the intent—puts your organization at risk.

Action Step:

Work with a values-aligned partner who brings deep expertise in equity-centered people systems—and collaborates with legal experts to make sure your hiring and pay practices are transparent, just, and compliant.

4. Where Discrimination Claims Begin

In small to mid-sized organizations, it doesn’t take a formal pattern to invite a lawsuit. If a single employee believes they have been treated unfairly compared to a peer of a different race, gender, or background—and you don’t have documentation to back up your decisions—that’s grounds for a claim.

Especially dangerous are:

-

Undefined or inconsistent pay practices

-

Undocumented performance issues

-

Unexplained departures or terminations

“I was let go unfairly” often becomes “I was paid unfairly,” especially when transparency is lacking.

The strongest legal defence will always be a clearly documented and communicated compensation program that includes:

-

Written policies

-

Job-aligned salary ranges

-

Data-based pay decisions

Action Step:

Review your performance review process and compensation decisions. Are they clearly documented, transparently communicated to the organization, and consistently applied?

5. Maternity, Bonding Leave, and Other Legal Gray Areas

Family leave is another area where many organizations go astray. For example, offering 12 weeks of maternity leave and 6 weeks of paternity leave may sound reasonable, but it’s often illegal.

Instead, structure your leave policies as:

-

Medical recovery leave (for birthing parents)

-

Bonding leave (for all parents, including adoptive and non-birthing partners)

The key is to define leave by the type of need, not the gender or identity of the employee.

Action Step:

Ensure your family leave policy complies with Equal Employment Opportunity Commission (EEOC) guidelines and is gender-neutral in language and application.

6. What You Can Consider in Pay Decisions

Not everything is off-limits. You can reward certain experiences—like lived experience relevant to the role—as long as it’s applied consistently.

Examples of job-related compensable factors can include:

Education Level

-

e.g., Bachelor's vs. Master’s degree when relevant to the role.

-

Must be required for the position (not just “preferred”) to justify higher pay, and only included if absolutely necessary—otherwise, they can create unnecessary barriers for individuals who have had disproportionate access to those degrees.

Skills or Certifications

-

e.g., CPA, LCSW, Teaching License, SHRM-CP.

-

Must be tied to performance in the job—not just “nice to have.”

Performance and Contribution

-

e.g., Exceeding established performance goals, consistently delivering high-quality work, or taking on significant additional responsibilities.

-

Merit-based increases should be tied to clearly defined, measurable criteria that are transparent and applied consistently across the organization. This ensures recognition for exceptional work is equitable and grounded in the role’s actual impact—not influenced by subjective preferences or informal advocacy.

As long as that experience is defined as a compensable factor (just like an advanced degree or certification), and used consistently, it’s legal and fair.

Action Step:

Clarify your list of compensable factors. What experiences, credentials, or skills influence pay—and are they applied to all staff equally?

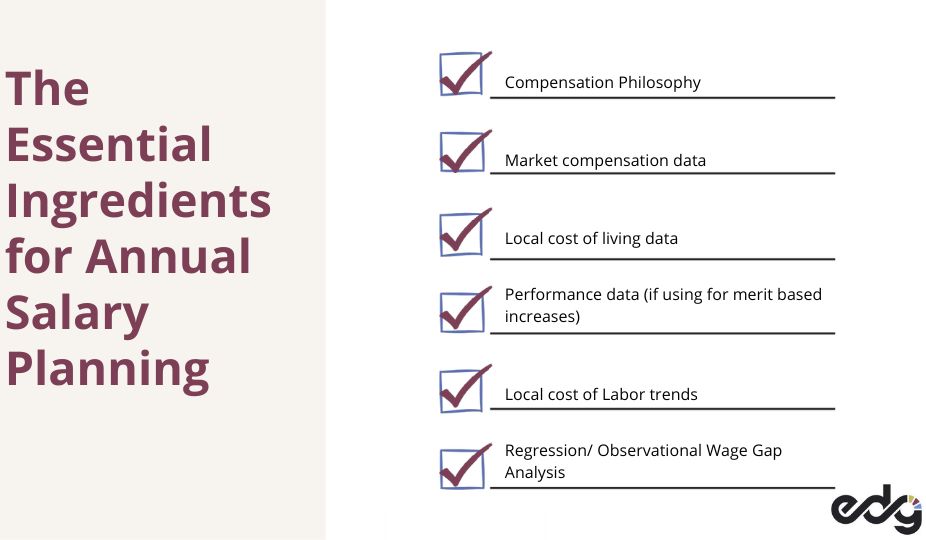

7. How to Start Auditing Your Compensation Program

Auditing your compensation program may sound overwhelming—but it doesn’t have to be. Here’s a basic checklist to get started:

Review FLSA classification

-

Are job descriptions aligned with exemption tests?

-

Do roles reflect actual duties, not just titles?

Check for pay transparency readiness

-

Do you have documented salary ranges?

-

Are they clearly communicated internally?

Evaluate equity and consistency

-

Are performance reviews tied to compensation?

-

Are decisions applied fairly across identity groups?

Assess documentation

-

Can you explain pay differences with a legitimate business reason?

-

Are those reasons clearly written and consistently used?

Know When to Bring in Outside Help

You don’t have to do this alone. If your team doesn’t have the time, capacity, or legal expertise to navigate complex compliance issues—or to design a compensation structure that’s both fair and defensible—it’s worth bringing in trusted experts.

That’s where Edgility Talent Partners comes in. We’ve helped mission-driven organizations across the nonprofit, education, and philanthropic sectors build compensation programs that are equity-centered, transparent, and legally sound. Whether you need a full audit or just a clear path forward, we’re here to guide you with care, clarity, and accountability.

Compliance Is a Cornerstone of Equity

You don’t have to choose between doing what’s right and doing what’s legal. In fact, the most effective compensation programs do both—advancing your mission while protecting your people and your organization.

If your organization is growing, changing, or simply unsure where you stand, it might be time for a compliance checkup.

Take the Next Step Toward Equitable, Compliant Pay

If you’re ready to ensure your compensation program is not only compliant but also truly aligned with your mission, download our free eBook, Compensation with Purpose: Designing Equity-Centered Pay Structures for Nonprofits, Education, and Healthcare. You’ll get practical strategies for creating pay systems that meet legal requirements, advance equity, and strengthen your position in the talent marketplace.

A Note on Legal Guidance

This post is intended to offer general guidance—not legal advice. Every organization’s context is different. For complex issues related to FLSA, pay transparency, or discrimination risk, we strongly recommend consulting with qualified legal counsel or HR compliance professionals.

Additional Resources to Support Compliance and Equity

If you’re ready to go deeper, these tools and references can help you evaluate your organization’s current practices and take steps toward a more compliant, transparent, and equitable compensation program.

1. FLSA Classification & Exemptions

DOL Fact Sheet #17A: Exemption for Executive, Administrative, and Professional Employees

Use this concise, 3-page checklist to review whether your exempt employees meet the legal criteria under the Fair Labor Standards Act. Essential for updating job descriptions and avoiding costly misclassifications.

2. Pay Transparency Laws by State

HR Dive – Pay Transparency Laws: A State-by-State Guide

Stay on top of current and upcoming legislation. This living resource summarizes which states require salary ranges in job postings and what else is expected.

3. Wage and Hour Compliance Basics

DOL: Wage and Hour Division Compliance Assistance

A helpful hub of fact sheets, guidance documents, and tools for employers navigating overtime, youth employment, recordkeeping, and more.

4. Avoiding Discrimination in Hiring & Pay

EEOC: Prohibited Employment Policies/Practices

Clarifies what employers can and can’t consider in employment decisions—including race, gender, age, and other protected characteristics.

5. Designing Equitable, Legally Sound Compensation Structures

Edgility Talent: Compensation Services

Learn how we partner with mission-driven organizations to build transparent, equity-centered compensation programs that also meet legal requirements.